Introducing PAYLATER Malaysia, the perfect option for hassle-free installments. Paying for your favorite insurance is now more affordable. PAYLATER Malaysia is a payment solution that enables you to “Buy Now, Pay Later” (BNPL). Amongst the benefits are:

- Up to RM3,500 instant shopping limit

- Installment with debit or credit card

- First checkout with only 25% payment

- 4-months ZERO-FEE installments

- Flexible tenure (up to 24-months) *T&Cs apply

- No maximum shopping amounts

Search for the desired insurance for your car and enjoy four months’ interest-free installments plus an RM50 instant rebate voucher if you check out with the PAYLATER Malaysia app.

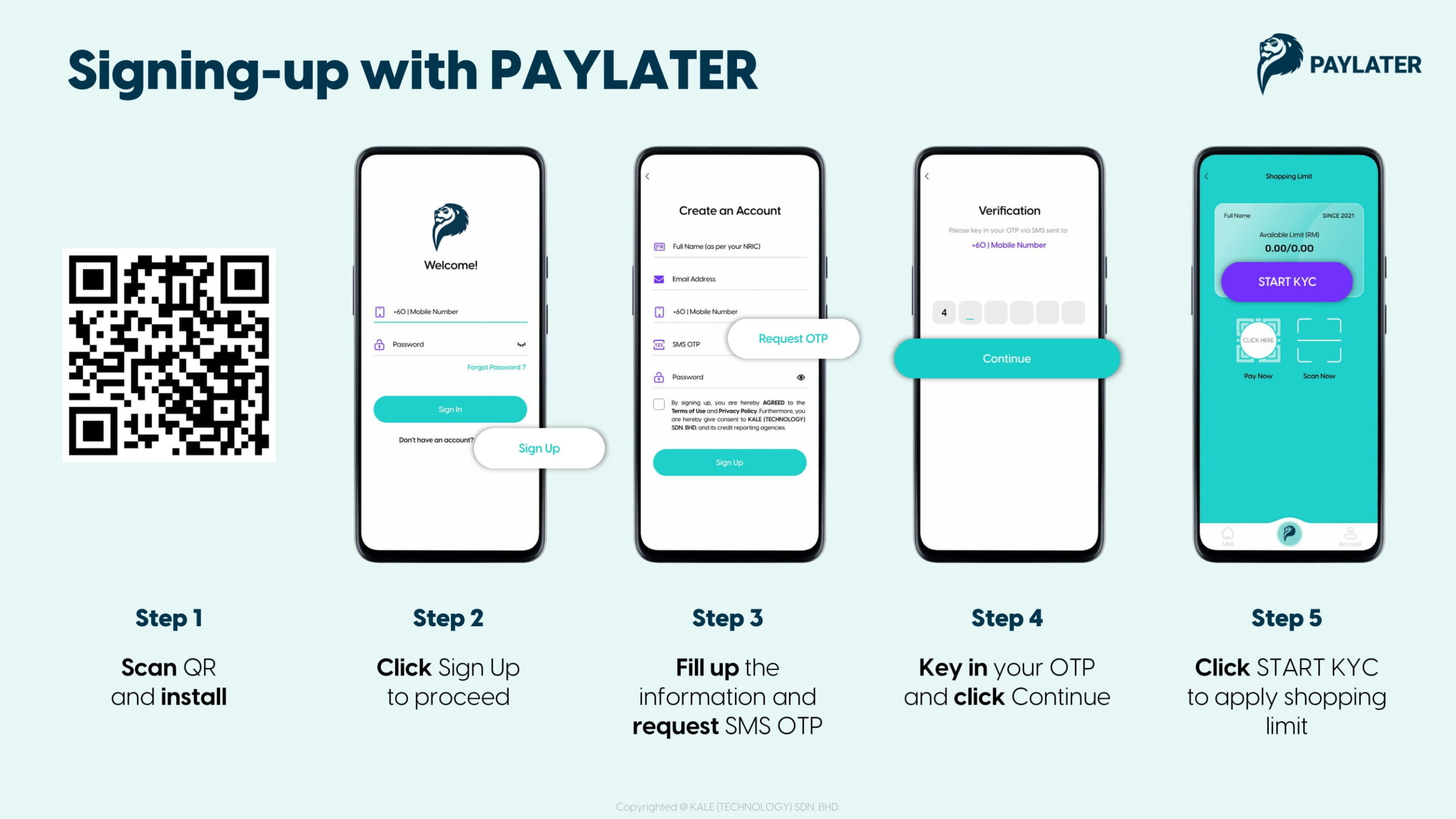

Signing-up with PAYLATER Malaysia

You will have to sign up for a user account with PAYLATER Malaysia on a smartphone. Follow these steps to sign in:

Step 1 – Installing the PAYLATER Malaysia app. Download the app PAYLATER Malaysia in App Store (iOS), Google Play Apps (Android) or Huawei AppGallery

Step 2 – Complete the registration process and click Sign Up.

Step 3 – Fill out the information and request a one-time password (OTP).

Step 4 – Key in your OTP to continue.

Step 5 – Click START KYC to apply for the shopping limit. The shopping limit can be adjusted later. Take a selfie and click Scan Face. Next, take a photo of your NRIC (front and back) and click NEXT.

After that, you will receive a confirmation email.

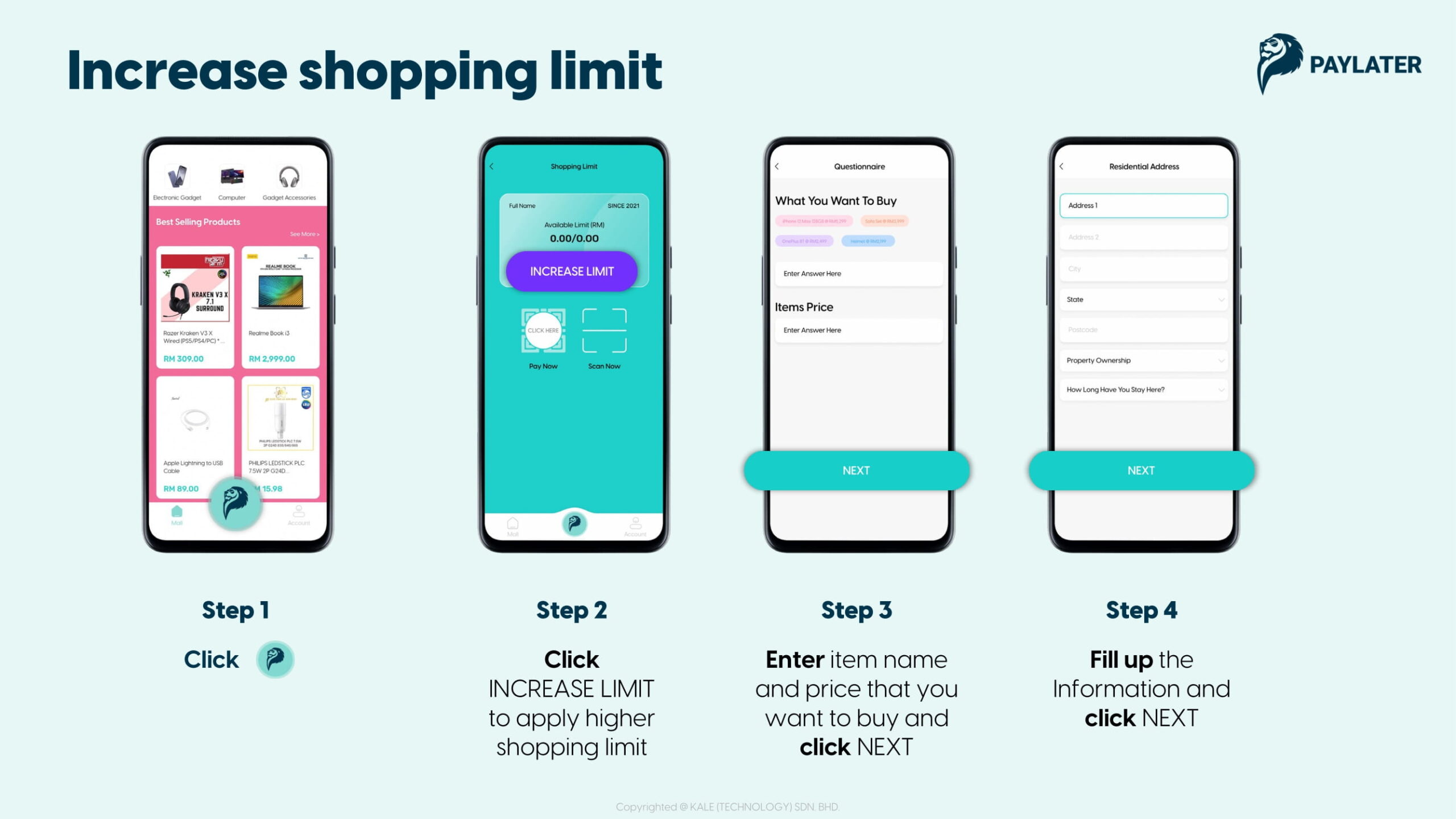

Increase Shopping Limit

If your instant shopping limit is lower than the price of insurance that you want to purchase, the limit can be increased by following the steps below:

Step 1 – Click on the PAYLATER Logo

Step 2 – Click INCREASE LIMIT to apply a higher shopping limit

Step 3 – Enter the item name and price that you want to buy and click NEXT

Step 4 – Fill up the Information and click NEXT

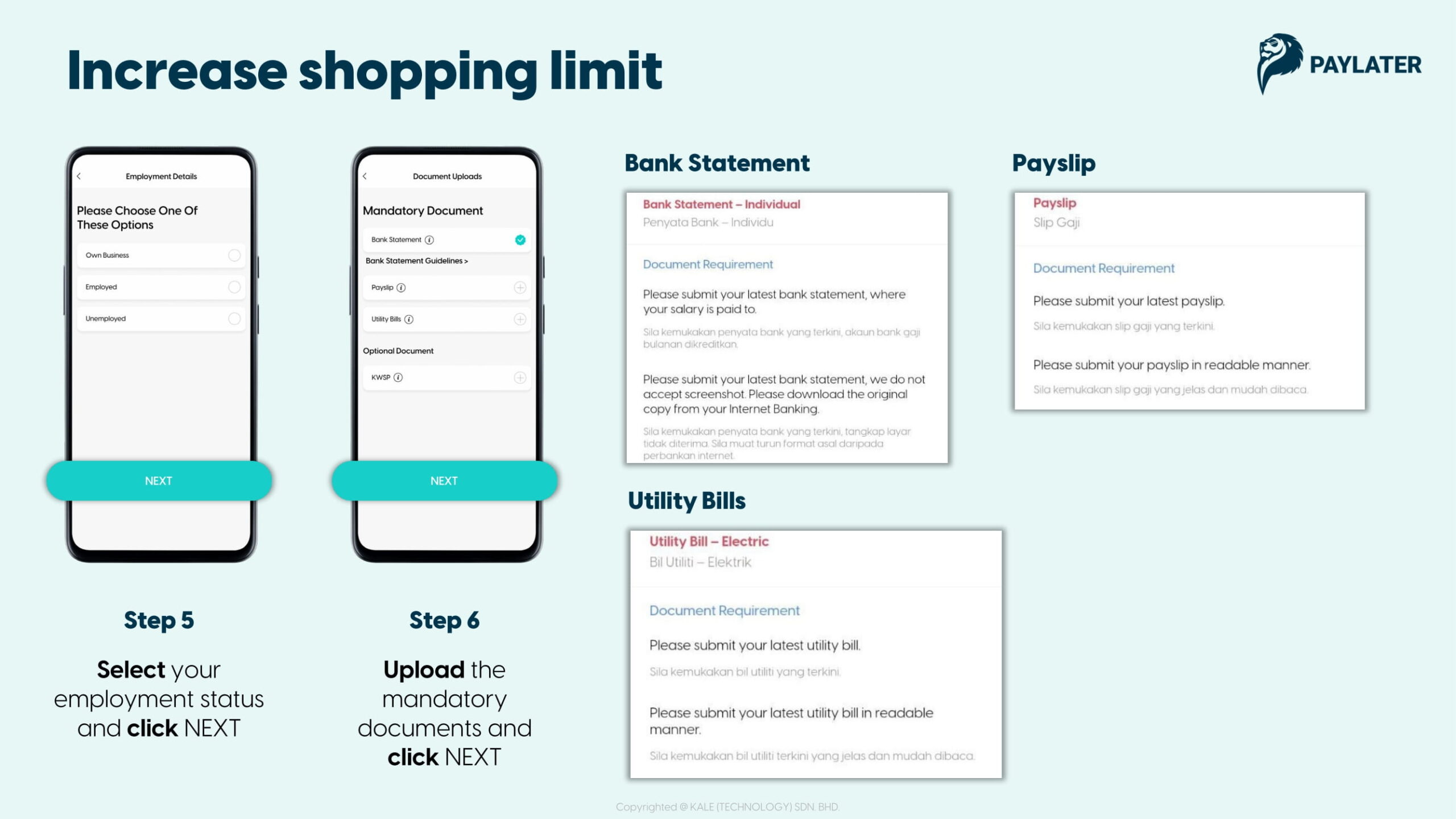

Step 5 – Select your employment status and click NEXT

Step 6 – Upload your latest mandatory documents (payslip, utility bills, bank statement) and click NEXT

You can add another ONE MONTH PAYSLIP as a supporting document in the Optional Document section. Please ensure all the documents submitted are not password protected. All higher shopping limit applications are subjected to PAYLATER Malaysia terms and conditions for approval.

Also, please note that increasing the shopping limit will take about 1 – 3 working days to succeed.

You may also need to re-submit some documents due to incorrect submission or insufficient information.

Don’t Forget to Checkout with Your RM50 Instant Rebate Cash Voucher

In the checkout process, you will be redirected to the PAYLATER Malaysia app. Remember to select your RM50 VOUCHER at the checkout page. Please follow the instructions below to claim the voucher:

Step 1 – Check your purchase amount and installment plan. The user needs to select the RM50 VOUCHER from the Select Voucher section

Step 2 – Enter your 6 digits security PIN to proceed

Don’t Hesitate, Get Covered Now

For folks who need to plan their budget this month, the PAYLATER Malaysia app is the perfect solution for you. With zero-fee installment plans for up to 4-months, you can worry less about managing your monthly budget. Plus, with a cash rebate of up to RM50, you can buy your insurance at Fatberry and even save more money. If 4-months is not enough, you can always extend your installment tenure to the duration that you want! *T&Cs apply.

Head over to Fatberry.com to get the best deal for your car insurance now and get the PAYLATER Malaysia vouchers while stock lasts!

Rebranding Fatberry–New Look And Logo For 2022!

We’re excited to announce that fatberry.com has rebranded with a new logo and colour scheme! This rebranding exercise is a precursor to the many initiatives we have lined up in the pipeline for our customers to enjoy and experience. In the past year, we’ve seen our...

Renew & Menang Hari-Hari

At Fatberry, the giving never stops. Enter our new GIVEAWAY contest! In partnership with PaySlowSlow, stand a chance to win weekly prizes or a GRAND prize every month if you renew your car insurance with FatBerry. Here’s how you can join: 1. Renew car insurance using...

#LifeAtFatberry: The Creative Freedom Out Of 9-to-5

Introducing our Creative Director, Fareed Saharudin! Fareed is a Universiti Teknologi MARA (UiTM) graduate where he studied Graphic Design & Digital Multimedia. He’s two years into his career and is already gaining a fantastic reputation in the creative field....

How Much Would Tesla Cars Cost If They Were Available In Malaysia?

Written by: Song Hui Jin According to Morgan Stanley, it forecasts that Tesla may be opening 5 new auto plants. The new auto plants will cater to India, ASEAN, Northern/Central Europe, and the U.S. And yes, the ASEAN plant is particularly important to Malaysia. Sadly,...

Cheat Sheet For Beginners on No Claim Discount (NCD)

At some point in our lives, we will have our own car. As much as it sounds exciting, it also comes with a certain responsibility, including knowing all the essential information. For newbies, NCD, betterment and insurance may seem intimidating at first but you can...

Car Maintenance Checklist: A Beginner’s Guide

The old adage of “failing to prepare is preparing to fail” also rings true for commuting. Here’s a car maintenance checklist to help you prepare for your commute if you’re new to driving and owning a car. The borders are open; you can now go balik...

Roadside Assistance: 5 Handy Car Services Apps

It’s always frustrating when your car experiences a breakdown mid-journey. Thankfully, there is plenty of roadside assistance ready to serve you! It can happen to anyone. It’s something that most people dread. It can be shocking and also be the epitome of an...

Super Easy Steps to Compare and Renew Your Insurance with Fatberry!

The process of renewing your vehicle insurance and road tax can be very troublesome. Not many are willing to queue at the post office or the “Road Transport Department” (JPJ), especially those who are busy working since it could take hours. compare If...

Road Tax Malaysia – Everything You Need to Know

What is Road Tax and How It Works In Malaysia Road tax is a tax fee paid annually by the owner of a vehicle used on the road. Road tax and car insurance are both obligatory for car owners to have. The bigger the vehicle, the more charges are required to be paid. Road...

Car Insurance Terminologies: The Basics (Part 2)

It's always helping to understand and know the basics and most common terminologies of car insurance. When comparing the best car insurance (or motorcycle insurance), it’s crucial for you to review the policies carefully before you sign on one of them. Most of...