Introducing PAYLATER Malaysia, the perfect option for hassle-free installments. Paying for your favorite insurance is now more affordable. PAYLATER Malaysia is a payment solution that enables you to “Buy Now, Pay Later” (BNPL). Amongst the benefits are:

- Up to RM3,500 instant shopping limit

- Installment with debit or credit card

- First checkout with only 25% payment

- 4-months ZERO-FEE installments

- Flexible tenure (up to 24-months) *T&Cs apply

- No maximum shopping amounts

Search for the desired insurance for your car and enjoy four months’ interest-free installments plus an RM50 instant rebate voucher if you check out with the PAYLATER Malaysia app.

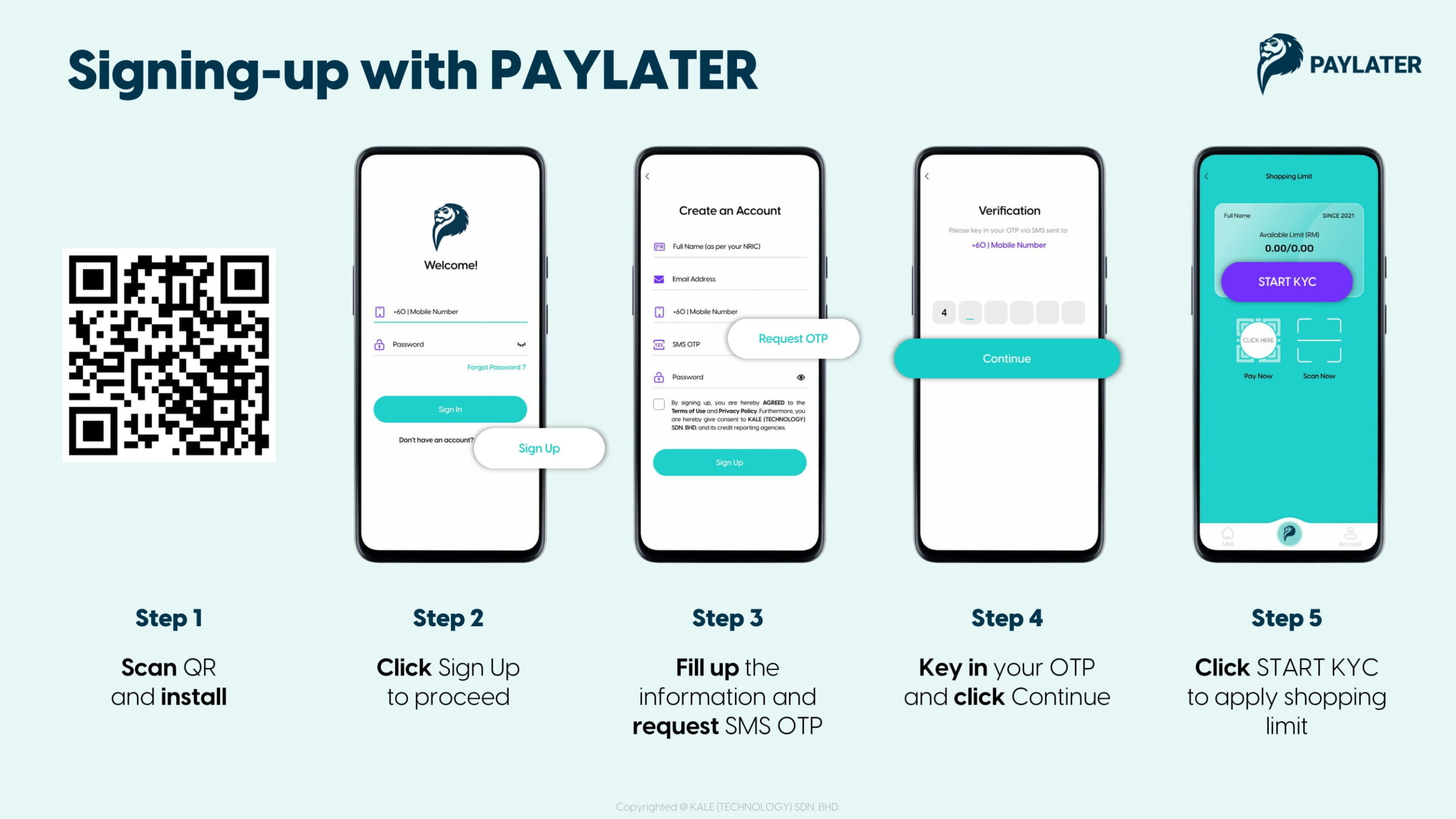

Signing-up with PAYLATER Malaysia

You will have to sign up for a user account with PAYLATER Malaysia on a smartphone. Follow these steps to sign in:

Step 1 – Installing the PAYLATER Malaysia app. Download the app PAYLATER Malaysia in App Store (iOS), Google Play Apps (Android) or Huawei AppGallery

Step 2 – Complete the registration process and click Sign Up.

Step 3 – Fill out the information and request a one-time password (OTP).

Step 4 – Key in your OTP to continue.

Step 5 – Click START KYC to apply for the shopping limit. The shopping limit can be adjusted later. Take a selfie and click Scan Face. Next, take a photo of your NRIC (front and back) and click NEXT.

After that, you will receive a confirmation email.

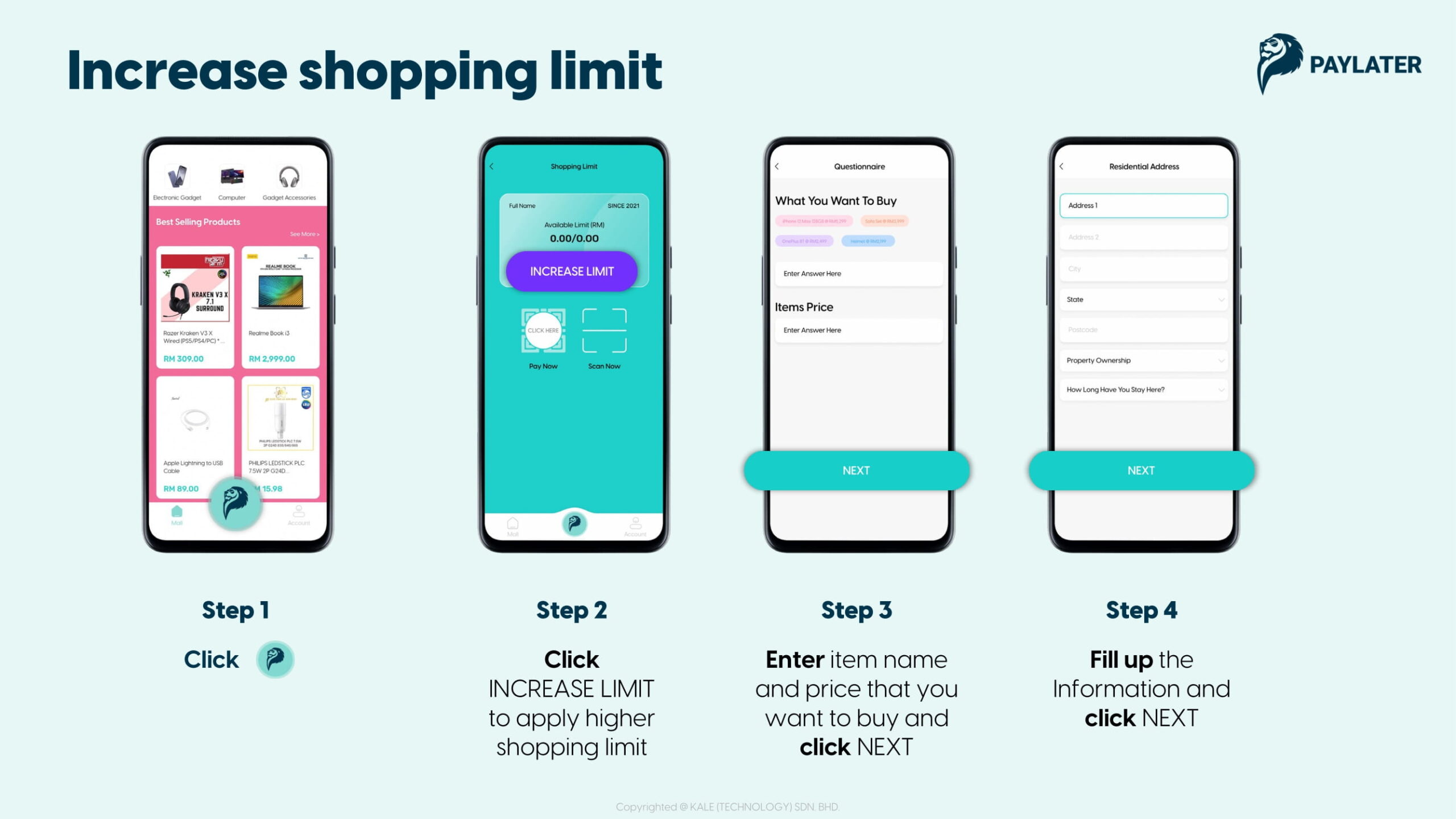

Increase Shopping Limit

If your instant shopping limit is lower than the price of insurance that you want to purchase, the limit can be increased by following the steps below:

Step 1 – Click on the PAYLATER Logo

Step 2 – Click INCREASE LIMIT to apply a higher shopping limit

Step 3 – Enter the item name and price that you want to buy and click NEXT

Step 4 – Fill up the Information and click NEXT

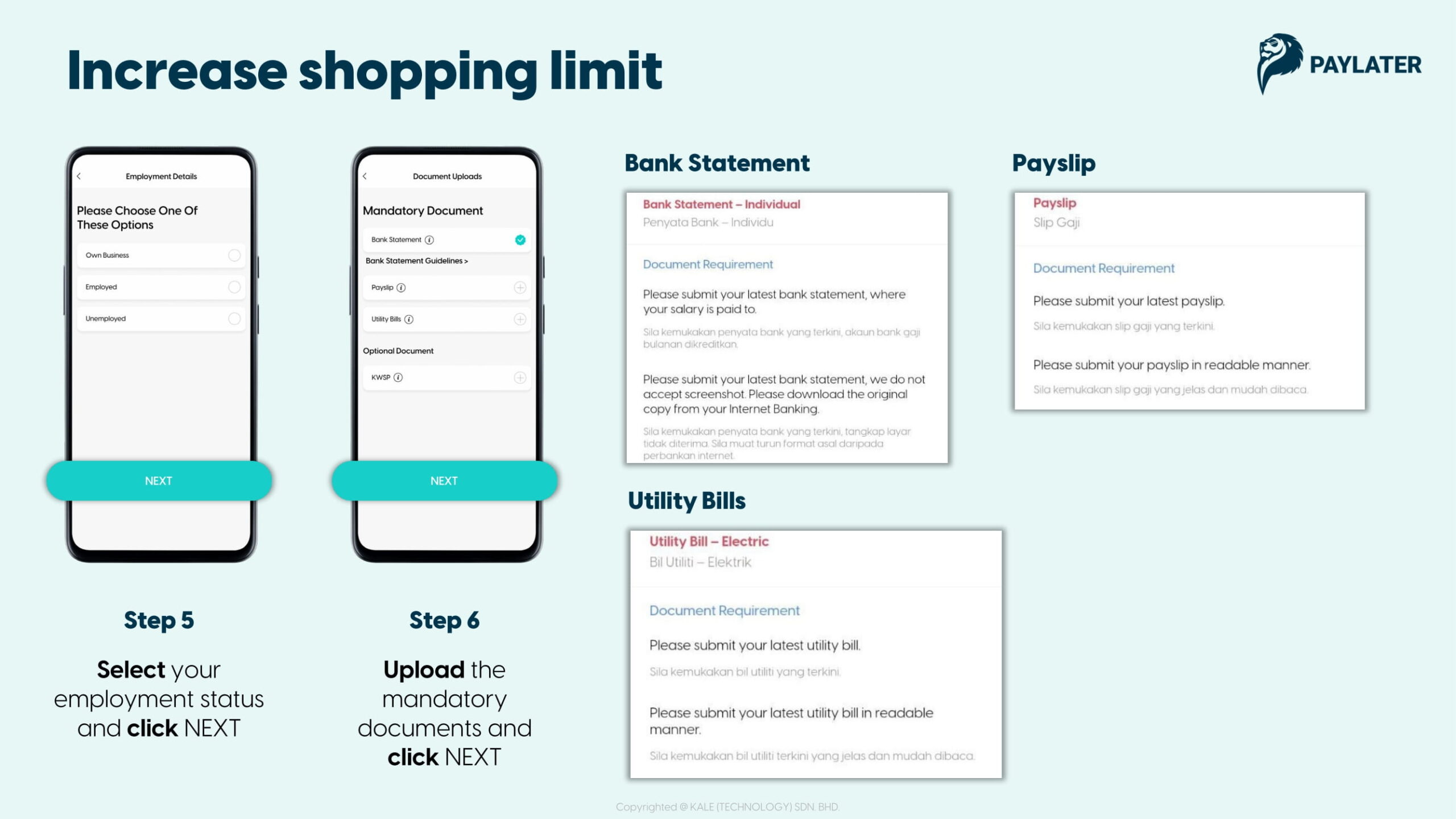

Step 5 – Select your employment status and click NEXT

Step 6 – Upload your latest mandatory documents (payslip, utility bills, bank statement) and click NEXT

You can add another ONE MONTH PAYSLIP as a supporting document in the Optional Document section. Please ensure all the documents submitted are not password protected. All higher shopping limit applications are subjected to PAYLATER Malaysia terms and conditions for approval.

Also, please note that increasing the shopping limit will take about 1 – 3 working days to succeed.

You may also need to re-submit some documents due to incorrect submission or insufficient information.

Don’t Forget to Checkout with Your RM50 Instant Rebate Cash Voucher

In the checkout process, you will be redirected to the PAYLATER Malaysia app. Remember to select your RM50 VOUCHER at the checkout page. Please follow the instructions below to claim the voucher:

Step 1 – Check your purchase amount and installment plan. The user needs to select the RM50 VOUCHER from the Select Voucher section

Step 2 – Enter your 6 digits security PIN to proceed

Don’t Hesitate, Get Covered Now

For folks who need to plan their budget this month, the PAYLATER Malaysia app is the perfect solution for you. With zero-fee installment plans for up to 4-months, you can worry less about managing your monthly budget. Plus, with a cash rebate of up to RM50, you can buy your insurance at Fatberry and even save more money. If 4-months is not enough, you can always extend your installment tenure to the duration that you want! *T&Cs apply.

Head over to Fatberry.com to get the best deal for your car insurance now and get the PAYLATER Malaysia vouchers while stock lasts!

Insurans Kesihatan di Malaysia (2023)

Insurans Kesihatan Apakah itu Insurans Kesihatan? Insurans Kesihatan ialah insurans yang biasanya bertujuan untuk menampung perbelanjaan rawatan perubatan swasta, termasuk perkhidmatan kemasukan ke hospital dan penjagaan kesihatan. Ia juga merupakan insurans yang...

Accident Claim Insurance: How To Claim in Malaysia?

Accident Claim Insurance Road accidents can happen for a variety of reasons, including skidding, entering the opposing lane, negligence, following vehicles too closely, and so on. As a result, it is critical that every car has insurance so that the cost of repairs is...

Zurich Travel Insurance

Zurich Travel Insurance Photo: Zurich Malaysia Every year, many people are eager to embark on a journey that will extend their horizons and provide them with priceless memories. Whether travelling alone or with family and friends, the joy that comes from seeing the...

Zurich Motorcycle Insurance

Zurich Motorcycle Insurance Photo: Zurich Malaysia Zurich Malaysia provides it all, whether you're seeking life, general, motor, or family protection. They can bring peace of mind knowing that the future of you is financially secure with their dependable services at...

Tune Protect Car Insurance

Tune Protect Car Insurance Photo: Tune Protect Tune Protect provides a variety of protection plans to match the specific requirements of each individual. No matter whether you're seeking protection towards or away on your travels, personal accidents, or even...

Etiqa Motorcycle Insurance

Etiqa Motorcycle Insurance What is Etiqa Motorcycle Insurance? Etiqa Motorcycle Insurance is an insurance firm that offers a full range of Life and General conventional insurance products, as well as Family and General Takaful plans. The company is owned by Maybank...

Panduan Insurans Cermin Kereta (2023)

Insurans Cermin Kereta Apa Itu Insurans Cermin Kereta? Insurans cermin kereta (windscreen) ialah perlindungan tambahan yang boleh anda tambahkan pada polisi insurans komprehensif anda. Ia adalah untuk menampung kos penggantian atau perbaikan cermin kereta anda....

Best Medical Insurance in Malaysia (2023)

Best Medical Insurance in Malaysia What is Medical Insurance? Medical insurance is insurance usually intended to cover the expense of private medical care, including hospitalisation and healthcare services. It is also an insurance that provides you coverage if you are...

Senarai Harga Insurans Kereta (2023)

Senarai Harga Insurans Kereta Jika anda ingin membeli kereta pertama anda dan ingin mengetahui senarai harga insurans kereta serta senarai harga insurans kereta mengikut CC, artikel ini adalah tepat untuk anda. Ketahui lebih lanjut tentang senarai harga insurans...

Windscreen Insurance: Everything You Need To Know

Windscreen Insurance What is windscreen insurance? Windscreen insurance is the primary auto insurance policy's add-on coverage. The windscreen insurance will be an add-on only under a comprehensive insurance policy. All door windows, the glass in the sunroof, and the...