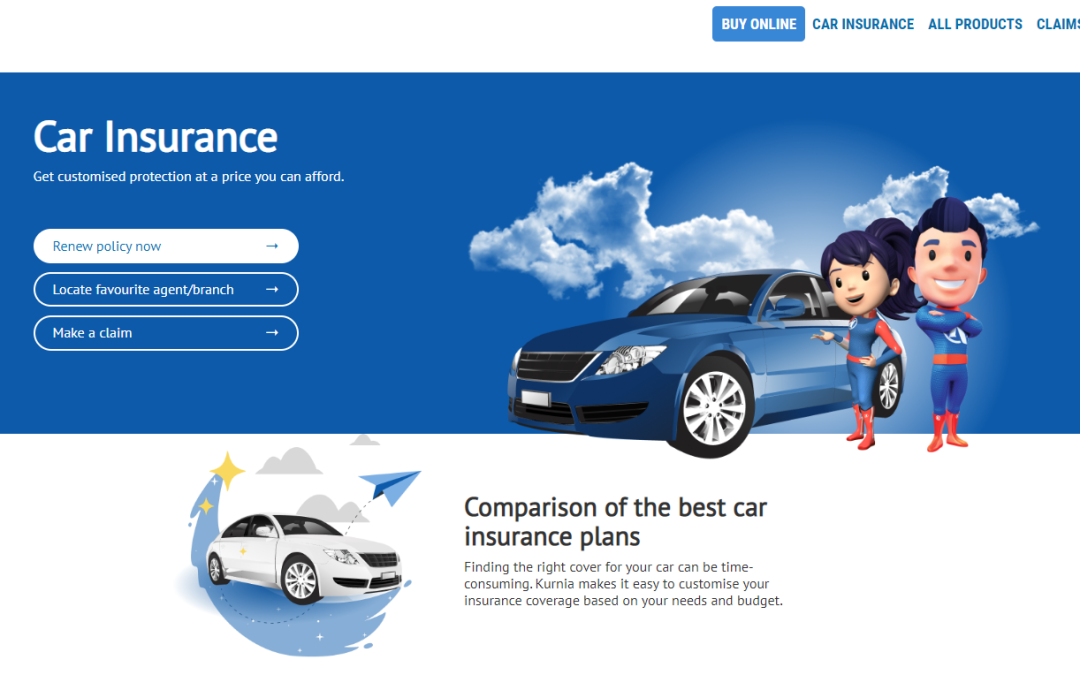

Special Perils Coverage Given the country's recent history of frequent flooding and more unpredictable weather, many vehicle owners have started to opt for special perils coverage. To discover more and acquire a better understanding of how special perils coverage...

RHB Medical Insurance FAQ

What is Medical Insurance?

Medical Insurance provides for hospitalization and surgical expenses incurred due to accidents or illnesses covered under the policy.

How does renewal work?

The policy is renewable at the option of the Policyholder. If there is no claim incurred in the first year of policy inception, we will not impose any exclusion upon you on the subsequent renewal in the later years. The renewal premiums payable is not guaranteed and it is subject to age banding and portfolio premium revision. If there are claims incurred within the first year of policy inception, you would still qualify for the renewal, subject to exclusions or premium increases.

Who is eligible?

The policy shall cover eligible persons between the age of 30 days to 70 years, renewable up to 100 years. Your policy may cover your spouse and dependent children subject to the following:

i. A legally married spouse aged below 70 years old at the time of first inclusion. Once included, the spouse may continue to be included up to the age of 100 years.

ii. Unmarried children between 30 days and 19 years old. For dependent children who are full-time students of institutions of higher education, the age limit is 23 years old.

What are the cover / benefits?

HOSPITAL BENEFITS

1) Hospital Room & Board (up to 200 days)

2) Intensive Care Unit (Up to 200 days)

3) Hospital Supplies & Services

4) Operating Theatre

SURGICAL & MEDICAL BENEFITS

1) Pre-Hospital Diagnostics Test (incl Medicines / Drugs)

2) Pre-Hospital Specialist Consultant (incl Medicines / Drugs)

3) Second Surgical Opinion (incl Medicines / Drugs)

4) Surgical Fees

5) Anesthetist’s Fees

6) In-Hospital Physician Visit

7) Post-Hospitalization Treatment

8) Organ Transplant

OUT-PATIENT BENEFITS

1) Emergency Accident Out-Patient Treatment

2) Out-Patient Physiotherapy Treatment

3) Annual Out-Patient Kidney Dialysis Treatment

4) Annual Out-Patient Cancer Treatment

OTHER BENEFITS

1) Protheses / Wheelchair Benefit

2) Home Nursing Care

3) Daily Cash Allowance at Government Hospital

4) Insured Child’s aily Guardian Benefit

5) Ambulance Fees

6) Medical Report Fees

7) Blood & Plasma

8) ID Band & Registration Fees”

Is this a Non-Cashless or Cashless Plan?

This is a Cashless Plan. You will be given a Medical card to facilitate admission to panel hospitals without the need to pay upfront

What is a Deductible Programme?

This option allows you to pay a fraction of the entire annual premium but you need to settle the first RM5,000, RM10,000, RM20,000, RM30,000, RM50,000 or RM100,000 (as per your choice) of eligible expenses on your medical bills. This benefit is especially good if you already have a Hospitalisation and Surgical Insurance policy.

How long is the waiting period?

The eligibility for benefits under the policy will only start 30 days after the Effective Date of the Policy.

Claims Procedure

In the event of cashless admission, kindly contact Asia Assistance at 03–7628 3777 or 03–7841 5777. In the event of claims, kindly contact RHB Insurance

Importance of Keeping the Official Receipt Claims Procedure

After the premium has been paid, please make sure you have been given an Official Receipt as a proof of payment. You are strongly advised to keep the Official Receipt for any future references.

What are the major exclusions under this policy?

a) Pre-existing illness

b) Specified illness occurring during the first 120 days of continuous cover. (Hypertension, Diabetes mellitus, Cardiovascular disease, Tumours, Cancers, Cysts, Nodules, Polyps, Stones of in the urinary and biliary system, Ear, Nose (including sinuses) and Throat conditions, Hernias, Haemorrhoids, Fistulae, Hydrocele, Varicocele, Endometriosis including disease of the Reproduction system, Vertebro-spinal disorders (including disc) and Knee conditions.)

c) Any medical or physical conditions arising within the first 30 days of the Insured Person’s cover or date of reinstatement whichever is latest except for accidental injuries.

d) Plastic/Cosmetic surgery, circumcision, eye examination, glasses and refraction or surgical correction of nearsightedness (Radial Keratotomy) and the use or acquisition of external prosthetic appliances or devices such as artificial limbs, hearing aids, implanted pacemakers and prescriptions thereof.

e) Dental conditions including dental treatment or oral surgery except as necessitated by Accidental injuries to sound natural teeth occurring wholly during the Period of Insurance

f) Private nursing, rest cures or sanitaria care, illegal drugs, intoxication, sterilization, venereal disease and its sequelae, AIDS (Acquired Immune Deficiency Syndrome) or ARC (AIDS Related Complex) and HIV (Human Immunodeficiency Virus) related diseases except the infection of HIV arose as a result of blood transfusion, and any communicable diseases requiring quarantine by law.

g) Any treatment or surgical operation for congenital abnormalities or deformities including hereditary conditions

h) Pregnancy, childbirth (including surgical delivery), miscarriage, abortion and prenatal or postnatal care and surgical, mechanical or chemical contraceptive methods of birth control or treatment pertaining to infertility. Erectile dysfunction and tests or treatment related to impotence or Sterilization.

i) Hospitalization primarily for investigatory purposes, diagnosis, X-ray examination, general physical or medical examinations, not incidental to treatment or diagnosis of a covered Disability or any treatment which is not Medically Necessary and any preventive treatments, preventive medicines or examinations carried out by a Physician, and treatments specifically for weight reduction or gain.

j) Suicide, attempted suicide or intentionally self-inflicted injury while sane or insane.

k) War or any act of war, declared or undeclared, criminal or terrorist activities, active duty in any armed forces, direct participation in strikes, riots and civil commotion or insurrection.

l) Ionising radiation or contamination by radioactivity from any nuclear fuel or nuclear waste from the process of nuclear fission or from any nuclear weapons material

m) Expenses incurred for the donation of any body organ by an Insured Person and costs of acquisition of the organ including all costs incurred by the donor during organ transplant and its complications.

n) Investigation and treatment of sleep and snoring disorders, hormone replacement therapy and alternative therapy such as treatment, medical service or supplies, including but not limited to chiropractic services, acupuncture, acupressure, reflexology, bone setting, herbalist treatment, massage or aromatherapy or other alternative treatment.

o) Care or treatment for which payment is not required or to the extent which is payable by any other insurance or indemnity covering the Insured and Disabilities arising out of duties of employment or profession that is covered under a Workman’s Compensation Insurance Contract.

p) Psychotic, mental, or nervous disorders, (including any neuroses and their physiological or psychosomatic manifestations)

q) Cost/expenses of services of a non-medical nature, such as television, telephones, telex services, radios or similar facilities, admission kit/pack and other ineligible non-medical items.

r) Sickness or Injuring arising from racing of any kind (except foot racing), hazardous sports such as but not limited to skydiving, water skiing, underwater activities requiring breathing apparatus, winter sports, professional sports and illegal activities.

s) Private flying other than as a fare-paying passenger in any commercial scheduled airlines licensed to carry passengers over established routes.

t) Expenses incurred for sex changes

Note: This is non-exhaustive. Please refer to policy documents for full details

Can I cancel my policy?

You may cancel your policy by giving a written notice to the insurance company. Upon cancellation, you are entitled to a partial refund of the premium provided that you have not made a claim on the policy.

| Period not Exceeding | Refund of Annual Premium |

| 15 days (applicable to renewal only) | 90% |

| 1 month | 80% |

| 2 months | 70% |

| 3 months | 60% |

| 4 months | 50% |

| 5 months | 40% |

| 6 months | 30% |

| 7 months | 25% |

| 8 months | 20% |

| 9 months | 15% |

| 10 months | 10% |

| 11 months | 5% |

| Period exceeding 11 months | No refund |

What do I need to do if there are changes to my contact details?

It is important that you inform us of any changes in your contact details to ensure all correspondence reaches you in a timely manner. You can reach us at customer.service@fatberry.com or +6011 2612 8112